Shopping = Happiness or So I Thought

Stick with me here, a spending detox is not as horrible as it sounds, promise. Like many, I love to shop. Amazon Prime, Marshalls, Target, and Rite-Aid are by far my biggest weaknesses. I can’t help but spend money on things I don’t actually need like reusable straws, more make-up, and that shirt, “it’s only $9.99 and I need it”. Oh, and we can’t forget about the happiness that’s experienced when I find “the deal”. It actually brings me a concerning amount of joy. Am I addicted to shopping, possibly? If so, I’m living proof that you beat any addiction in the same 30 days it takes to create a new habit.

swapping habits

One day I woke up and had an epiphany about spending money. What if I could trick my brain into liking to save money as much or more than I like to spend it. Crazy talk, right? Things I was considering included deleting the Amazon Prime app off of my phone, not going in any stores, or maybe I’d have more luck locking myself in my room with no TV, no internet and no phone. All of those options were too extreme and if I’ve learned anything in my personal development journey, it is not to bite off more than you can chew. It only leads to disappointment and failure. Just as I was about to give up the light bulb went off, what if I create my own personal spending detox, just like I do when I want to kickstart a weight loss plan.

Write the rules one page at a time

What is a spending detox? I didn’t know at the time because I was making it up as I went. Essentially it is a month-long no spend challenge. Almost 30 days later I’m coming to you from the other side. Today I’ll do my best to explain the process, the rules, the savings, and the outcome. Giddy up, and let’s get to saving money.

The Support Group

If there is something that I would absolutely need to accomplish a task of this magnitude, it’s a support system. It was scary and intimidating to face one of my biggest demons head-on. Why go it alone, find yourself a support group. In this case, I called upon my family. The week before our spending detox happened I called a very important family meeting. Why do my kids think every time we have a family meeting that they are getting a sibling? Sorry kids, the baby gates are closed, for real this time. I started off with a game plan as to how we were going to save money. I think they all would have rather had a sibling, except for my husband. He was practically jumping for joy when he found out that there was no baby on the way AND we were going to save money. Eric is the thrifty, ramen noodle eating kind of guy.

What is a Challenge Without a Reward

When I mentioned a prize at the end of our spending detox everyone perked up just a bit. We started brainstorming about all of the things we could do to celebrate our hopeful victory. Maybe an iPad, a comfy new chair, video game accessories, a mini-stay-cation. The opportunities were really endless. We settled on a list of possibilities and decided to revisit them once we officially crossed the finish line and claimed our victory.

The Rules

Obviously, we couldn’t survive without spending any money for 30 days. We are a family of 5 made up of three wasteful kids, someone who hates leftovers and someone who could survive on 23 baby carrots a day (spoiler alert, that’s not me). Oh yea, and I can’t forget to mention that we are still on quarantine, which means extra food and TP.

With a blank piece of paper, a hope, and a dream we began to decide what we could spend money on. Things included were bills, business expenses, groceries (only the necessary kind). Sorry Kebbler and HoHos, I guess we will see you next month, maybe. Also, we would allow anything that was an actual emergency need. Thankfully, 25 days in and no emergencies yet.

Operation Preparation

Oh boy, it’s getting real. As we got closer to crunch time we decided to do one last big stock up before the detox. You know, just like the last cheeseburger before a diet, but this was actually helpful. Let me break down my pre- detox shopping habits for you. If I couldn’t see it, find it, or it was half way gone I bought new. This caused an over abundance of select items like the 15 bags of powdered sugar in my basement. We also had a shocking number of half-used bags of chips and tubes of mascara and tooth paste. It seemed like there had to be an unwritten rule in the house that things were only good until the half waypoint. After that, all bets are off and we must abort immediately. For someone who was trying to save money, I was actually a little appalled by the waste. Hmmm, maybe this little tingle of frustration would fuel my new savings habit. I sure hoped so.

I went through every pantry, drawer, freezer, and fridge in my house. I did an inventory of all of the items we had on hand. Yes, even the half-used ones. Once I went through our cleaning supplies and paper products I moved on to the food. The goal was to create a 30-day meal plan where we would use all the food in my refrigerator and freezer first. To me, it looked as if we had enough food to last us months. In all reality, it was only a few weeks worth of food at the most, but still, we were saving grocery money by eating what we had on hand first. I even decided that I would try to eat the “never as good the second time”, leftovers.

Retrain the Brain

During our no spend month almost every day something would pop into my head that I “needed”. I’m going to go ahead and use that term loosely. Not sure that the new office chair that I’ve been eyeing up is actually a need. The one I am sitting on right now is holding me up just fine.

The first day was the hardest. Normally something pops into my head, I get scared that if I don’t buy it right now I’ll forget about it. Then I’ll get to the day I really need the said item and I’ll be kicking myself because I forgot to buy it. This is why Amazon sends me flowers and chocolate every year for my birthday, kidding. They do have to love people like me, the ones who don’t binge eat, they binge shop. Shopping makes everything better when you are happy, sad, celebrating, or just plain bored. By the way, shopping for groceries doesn’t count. That only leads me to frustration and sadness. All the money spent on food and what do you have to show for it? I’ll let you answer that one.

Habit Swap

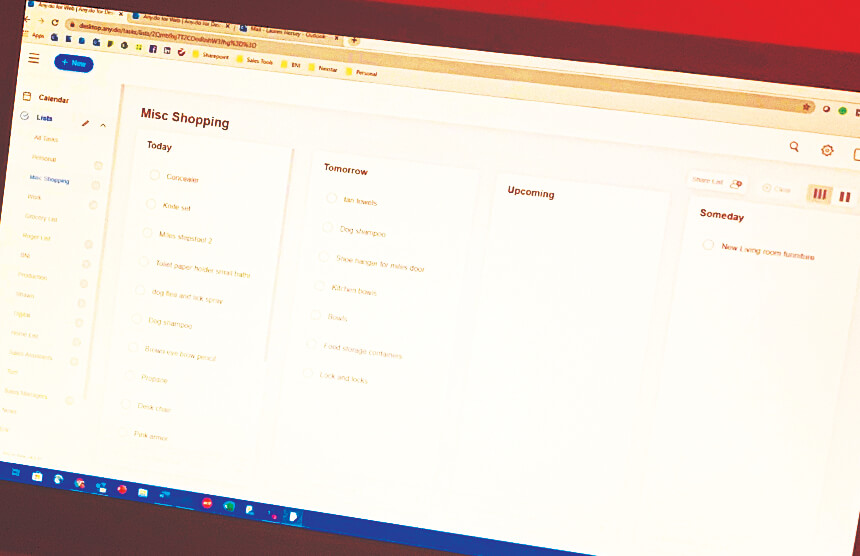

Okay, back to not impulse buying. Every time something that I “needed” would pop into my head I would add it to my “Miscellaneous Shopping List” on Any.Do. This list consisted of anything except groceries that I would normally impulse purchase.. Now the idea is out of my head and safely on my list to be evaluated for next month.

Potential Savings

Let’s look at the Misc. shopping list for a second to get a quick total of everything that I definitely would have bought if I wasn’t trying to save money. Here it goes. I’m just going to take a guess at roughly how much each item actually costs.

Step stool $20, toilet paper holder $5, eyebrow pencil $5, desk chair $150, LulaRoe leggings $25, chair for bedroom $200, lime green dog bed $25, pot holders $3, dog shampoo $3, kitchen bowls $15, food storage containers $25, over door shoe hanger $10, pink armor nail polish $15 and tan towels $20, new cellphone case $20.

Oh my gosh, things really do add up. $541 so far, I don’t know if I should be embarrassed or impressed at my willpower. Also, I’ve stayed out of stores as much as possible and we haven’t ordered food out. Sometimes I wonder if Target and Rite Aid miss me too? My kids now know not to even to ask if they can buy anything, which is really nice.

To sum it up, saving money by doing a spending detox hasn’t been horrible and I learned a few lessons along the way. I think most things can be accomplished with support, preparation, and guidelines. I also learned that impulse shopping is only a temporary feeling of happiness. The real joy comes from accomplishing a goal that you worked hard to do.

If saving money and developing healthy spending habits is something on your list I encourage you not to wait. I can promise it will never be the right time and something always will conveniently come up. Take the first step, develop your plan and then jump in. You’ll never know how much money could have been saved if you never try.

Save Smart, and Stay Strong. You got this!

Leave a Reply